When Do I Sign Up For Medicare?

Estimate when you’re eligible for Medicare

Use the Eligibility calculator from Medicare.

When you sign up for Medicare depends on your situation:

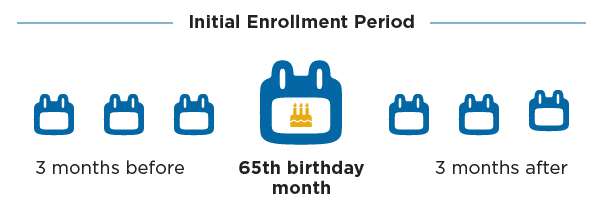

Initial Enrollment Period

You can sign up for Medicare (Part A and Part B) 3 months before the month of your 65th birthday, during your birthday month, or 3 months after your 65th birthday month. This is called the Initial Enrollment Period.

If your birthday falls on the 1st of the month, Medicare treats it as if your birthday took place in the previous month. So, if your birthday is on May 1, Medicare treats it as an April birthday and your 7-month window is shifted back 1 month.

Calculate your Initial Enrollment Period

65 or older and ready to retire

If you work past the age of 65 and get health care coverage through your employer, you can wait to sign up for Medicare (Part A and Part B) until you retire or your coverage with your employer expires. You have an 8-month window to sign up for Medicare (Part A and Part B) in this scenario. This is considered a Special Enrollment Period.

65 or older and still working

If you are 65 or older, currently employed, and get health care coverage through your employer, you can wait to sign up for Medicare (Part A and Part B) until you retire or your coverage with your employer expires. You have an 8-month window to sign up for Medicare (Part A and Part B) in this scenario. This is considered a Special Enrollment Period.

65 or older and have health insurance through my spouse

If you have health insurance through your spouse’s employer, you don’t need to sign up for Medicare (Part A and Part B) when you turn 65 or retire. You can sign up for Part A and Part B up to 8 months after your spouse’s employer coverage ends. This is considered a Special Enrollment Period.

My spouse is enrolled in Medicare, am I?

No, you are not automatically covered by Medicare through your spouse. Unlike health insurance you may have had through your employer, Medicare does not allow you to receive coverage through your spouse. In order to receive Medicare coverage, you must apply for it individually.

Medicare Special Enrollment Periods

There are certain Special Enrollment Periods (SEPs) for Medicare that let you make changes to your Medicare Advantage plan and Medicare prescription drug coverage. Some situations that qualify as a Special Enrollment Period include moving, losing your current coverage, and more. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

Most common Enrollment circumstances

- You change where you live

- You lose your current coverage

- You have a change to get other coverage

- You plan changes its contract with Medicare

If you didn’t sign up for Medicare during your Initial Enrollment Period or during a Special Enrollment Period, you can still sign up during the General Enrollment Period (January 1—March 31 of each year). However, it’s something you’ll want to avoid because coverage won’t begin until July 1. That may leave you uncovered for several months—and 100% responsible for any medical expenses you may have.